Congress Must Reform Unemployment Insurance

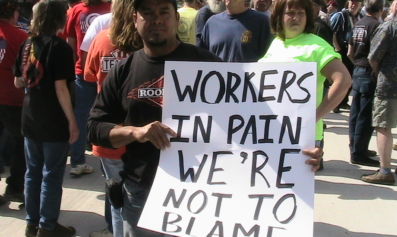

Stronger federal standards are needed to ensure the unemployment insurance system provides adequate support for all workers and families experiencing job loss.

Federal Action Is Needed to Fix Unemployment Insurance

Unemployment insurance (UI) should act as a financial bridge so that anyone who’s out of work can sustain themselves and their family while they look for a job.

UI benefits should be:

- Sufficiently generous and last long enough so that workers can make ends meet until they can find a good job.

- Readily accessible and available to all workers when they need them.

- A reliable way to stabilize the economy during downturns.

But without strong federal standards, workers face an uneven patchwork of state UI laws that frequently fall far short of these goals.

To begin to fix the flaws in the UI system—flaws with deep roots in how UI was originally created in the 1930s to benefit white male breadwinners—Congress should pass critical UI reforms, such as the Unemployment Insurance Modernization and Recession Readiness Act.

Most Unemployed Workers Don’t Receive Any UI Benefits

Due, in large part, to overly restrictive and outdated state eligibility requirements, only a small share of unemployed workers ever receive UI benefits.

States with a larger share of Black residents are more likely to have tighter restrictions on UI eligibility and less generous benefits.

Currently, less than 30% of unemployed workers receive UI benefits.

Unemployed Black workers are 24% less likely to receive UI benefits than their white counterparts.

Many underpaid, temporary, part-time, and gig workers, as well as those classified as independent contractors, are unfairly excluded from eligibility.

These exclusions disproportionately impact workers of color, women workers, older workers, workers with disabilities, and transgender workers.

The one public benefit intended to support unemployed workers is unemployment insurance. When workers lose their jobs but don’t receive UI benefits, workers and their families are likely to face extreme financial hardship. That’s not right, and it needs to be fixed.

Benefit Amounts Are Too Low for Most Workers to Make Ends Meet

Most states’ UI benefits are too little for workers to sustain themselves and their families. Benefit amounts vary widely by state, but the average weekly benefit nationally is just $382 per week and replaces only about 40% of a worker’s prior pay.

Many states pay even less, particularly states in the South that have higher proportions of Black residents.

In Mississippi, for example:

- The average weekly benefit was less than $225 per week in 2023.

- But many unemployed workers don’t even receive that much.

- In fact, the minimum weekly benefit in 2023 was shockingly low—just $30 per week.

- Yet workers would need $689 in weekly income just to afford a modest two-bedroom apartment in Mississippi.

The loss of a job should not cause anyone grave economic distress. Robust federal standards are needed to ensure that no matter where unemployed workers live, their UI benefits will be enough to sustain them and their families while they seek new employment.

Benefits Are Often Cut Off Before Workers Can Find New Jobs

Up until 2011, all states offered at least 26 weeks maximum of state UI benefits. But then several state legislatures began cutting back available benefits to less than 26 weeks, including:

- Michigan

- Missouri

- North Carolina

In subsequent years, other states followed suit, including:

- Alabama

- Arkansas

- Georgia

- Florida

- Idaho

- Iowa

- Kansas

- Kentucky

- South Carolina

By 2023, 14 states were providing less than 26 weeks of benefits.

And even in states that maintain the 26-week standard, many unemployed workers are not eligible for the maximum of 26 weeks.

It takes time to find a new job after a lay off. As a result of structural racism, workers of color and Black men in particular experience longer periods of joblessness than their white counterparts. One study found that an unemployment spell for Black and Asian workers lasted an average of nearly 26 weeks, compared with 19 weeks for white workers.

Workers need basic economic security while they look for work. Clear federal standards are needed to ensure that, in every state, UI benefits will last for a reasonable amount of time so that workers can find new jobs and have the support they need while looking for that job—no matter what state they live in.

The UI System is Severely Unprepared for the Next Recession

The COVID-19 pandemic exposed how the UI system wasn’t able to support the millions of people who lost work in the resulting economic downturn.

Millions of workers, including gig workers and self-employed people, were suddenly unemployed and weren’t eligible for state UI benefits. State UI systems were overwhelmed by the volume of claims, causing huge backlogs with workers waiting weeks or months before receiving any payments.

Workers who were able to receive UI often saw benefits that were too low and cut off too soon.

Congress responded to workers’ calls for action by enacting a series of critically important, yet temporary, emergency pandemic UI programs that:

- vastly expanded benefit eligibility

- boosted benefit amounts

- extended additional weeks of benefits

- stabilized the economy (preventing a longer and deeper recession).

But beginning in May 2021, officials in 22 states unilaterally and prematurely cut off the pandemic UI programs. And in September 2021, Congress allowed the programs to expire nationwide.

The UI system returned to its flawed pre-pandemic state, with huge eligibility gaps, insufficient benefit amounts and durations, underfunded and inadequately staffed state agencies, and outdated technologies—a UI system dangerously unprepared for another recession.

How Congress Can Fix Unemployment Insurance

First and foremost, Congress must pass the Unemployment Insurance Modernization and Recession Readiness Act—a bill introduced by Senators Ron Wyden (D-OR) and Michael Bennet (D-CO) and Representative Don Beyer (D-VA) that lays the groundwork for transforming the UI system.

When enacted, the Unemployment Insurance Modernization and Recession Readiness Act will:

- Increase access to UI benefits for:

- part-time workers

- temp workers

- workers whose earnings fluctuate over time

- workers who must quit their jobs for certain compelling reasons—including unusual risks to their health and safety.

- Raise benefit amounts to replace a larger share of workers’ prior earnings.

- Mandate that states offer at least 26 weeks of UI benefits.

In addition, the bill fixes the Extended Benefits program to automatically make additional weeks of federally funded benefits available sooner in an economic downturn as unemployment rises.

The bill also creates a new Jobseeker Allowance—a benefit for unemployed workers who are not eligible for UI or who receive only a small UI payment. Workers who’d benefit include:

- self-employed workers

- jobseekers newly entering or returning to the workforce, such as:

- recent graduates

- parents and caregivers

- people seeking work after incarceration.

Passing the Unemployment Insurance Modernization and Recession Readiness Act is the critical first step Congress must take to fix unemployment insurance. But Congress must also:

- provide adequate funding for states to update their UI technology infrastructure.

- provide a steady stream of administrative funding.

- reform the UI financing system to make sure enough money is collected to pay ample benefits to unemployed workers.

Congress can and must fix the unemployment insurance system to enable all workers to thrive.

Key Resources

Reforming Unemployment Insurance: Stabilizing a System in Crisis and Laying the Foundation for Equity

Reforming Unemployment Insurance is a Racial Justice Imperative

7 Things We Learned About Unemployment Insurance During the Pandemic

Federal Standards Needed to Provide Equitable Access to Unemployment Insurance

Testimony of Rebecca Dixon: Examining the Administration of the Unemployment Insurance System

NELP Applauds the Introduction of the Unemployment Insurance Modernization and Recession Readiness Act

NELP's State Unemployment Insurance Policy Hub

The UI Policy Hub offers resources to improve state UI programs and strengthen economic security for workers and their families.

Read More